Life Insurance

Uncover the benefits and start considering the plan that's right for you.

Why do I need a Life Insurance Policy?

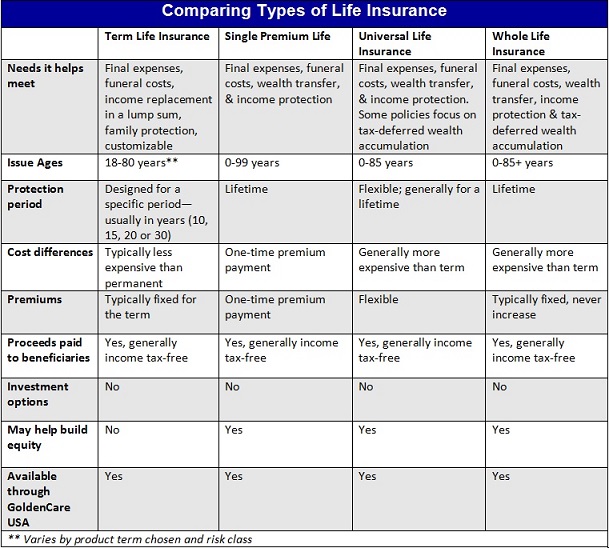

A Life Insurance policy protects your family from the strain of final expenses. Term Life Insurance generally provides protection for a set period of time, while permanent insurance, such as Whole and Universal Life Insurance, provides lifetime coverage.

Death benefits from all types of Life Insurance are generally income tax-free.

• Average Funeral cost is $10,000 – $12,000 [1]

• Average Cremation cost is $3,000 – $5,000 [2]

Social Security pays only $255 as a survivorship benefit, if you qualify. [3]

Life Insurance can help:

- Pay final expenses, such as funeral costs, credit-card debt and taxes.

- Replace income your family would need to maintain their standard of living.

- Pay off your mortgage loan or other personal and business debts. If you rent your home, it can create a fund for future rent payment.

- Create an education fund for your children.

- Create a family emergency fund.

- Protect future insurability – no matter what your future health, your policy will stay in force as long as premiums are paid.

- Build cash values on a tax-favored basis – in permanent life insurance plans. When the policy is properly funded, these cash values can be borrowed through policy loans.

GoldenCare offers several varieties of Life policies:

GET A FREE QUOTE!

We offer various insurance products to help you with your insurance needs.

Final Expense Life Insurance

Final Expense Life Insurance

Final Expense Life insurance helps take care of your final expenses (i.e. funeral, cremation, casket, cemetery etc.), as well as outstanding medical bills or debts. Any excess funds are paid to the policy’s beneficiary.

- Funds are paid first to the funeral home, excess funds go to your beneficiaries

- Funds cannot be attached by creditors such as nursing homes or lawyers

- Tax Free benefits upon death, unlike CD’s, annuities or money markets

- Death Benefits avoid probate costs and delays

- Assurance you will never need to have a welfare funeral

Why choose Final Expense Life Insurance rather than a pre-paid funeral through a funeral home?

- If the funeral home goes out of business you might not be able to recover your money

- The funeral home might be sold or merge with another that you would not want handling your final arrangements, and they might not grant you a refund

- What if you move, making your pre-paid funeral in a certain locality impractical?

- A Final Expense Life Insurance policy or Trust allows your arrangements to be handled by anyone you wish, such as your personal representative, a relative, friend, or funeral home — anywhere — at the time of your passing

Single Premium Life Insurance

Single Premium Life Insurance

Single Premium Life provides lifetime protection and requires only one premium payment paid up-front to guarantee payment to beneficiaries. Since this large, up-front payment begins accumulating cash value immediately, the policyholder will earn more than holders of policies paid in installments. Under the tax reform act of 1986, the premium appreciates tax-free.

Term Life Insurance

Term Life Insurance

Term Life insurance is temporary insurance for people who want:

- To supplement Life Insurance from work

- A fixed benefit amount for a specific period of time

- Additional insurance protection during child-bearing years

- A death benefit protection with a Return of Premium Option

- To cover short-term debts and needs

- To provide long-term protection to help pay off a mortgage, or college education

- A policy that lasts for a specific period of time (i.e. 10, 15, 20 or 30 years)

Universal Life Insurance

Universal Life Insurance

Universal Life insurance is flexible-premium, adjustable-benefit, permanent life insurance that can accumulate values beyond the guaranteed cash value. In addition to its cash values, which can be used for children’s educations, to supplement retirement income and for incidental expenses, universal life insurance is flexible enough to change as your needs change.

Universal Life insurance protection offers the following advantages:

- Lower cost than Whole Life Insurance

- No-Lapse Protection

- A tax-advantaged savings element that provides a cash value with a guaranteed minimum interest rate

- Flexibility to adjust your premium payment and death benefit as your needs change

- Favorable loan features

Whole Life Insurance

Whole Life Insurance

Whole life insurance policies provide coverage until your death, and also feature a cash value component. The policy builds cash value the longer it is in effect – in turn, that cash value may be borrowed against and used for various expenditures throughout your life.

Whole Life insurance protection provides:

- Permanent insurance protection over an individual’s lifetime

- Helps protect your loved ones from financial hardship

- Cash value builds over time

- Affordable premiums fit your budget

- Tax-deferred cash value accumulation

- A level premium and coverage as long as you continue to pay

- Premiums don’t increase as you grow older

Funeral Expense Trust/ Irrevocable Burial Trust

Funeral Expense Trust/ Irrevocable Burial Trust

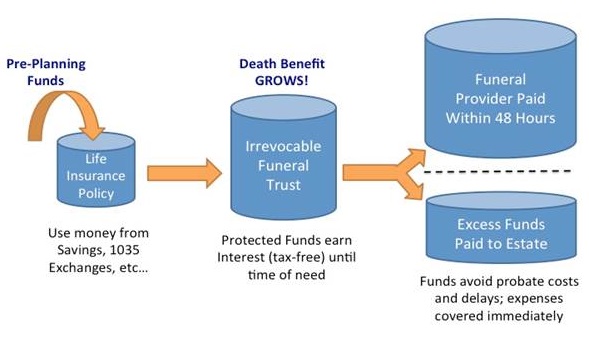

A combination of life insurance and a funeral trust creates a secure plan to cover your final expenses. A life insurance policy purchased to cover the anticipated costs of your funeral is assigned to an Irrevocable Burial/Funeral Expense Trust.

This assignment offers three main advantages:

1). At the time of death, policy proceeds do not have to go through probate and are available immediately to pay your final expenses

2). The policy may not be considered an asset in determining Medicaid and SSI eligibility

3). Funds are protected from creditors